India is emerging as a modern economy and about 95% of India’s EXIM cargo trade by volume and 70% by value is transported by sea. At present India’s foreign trade represents less than 3% of global trade and the National Maritime Agenda set a target of 5% of global market share by the year 2020. Coastal shipping has a significant role to play in Indian economy to achieve this ambitious target.

Despite of having a rich and proud Maritime tradition and a long coastline of about 7517km studded with 13 major and 185 Non-Major (Minor / Intermediate) ports , the potential of coastal shipping has not yet been fully exploited in India.

Cabotage policy has an important bearing on the coastal shipping of a country. Most of the maritime nations like USA, China , Indonesia etc practice an absolute Cabotage and it restricts movement of coastal cargo by their own flag vessels .

By definition , coastal vessel means a vessel of Indian registry with exclusive Indian crew, engaged in carriage by sea of cargo or passengers, from one Indian port to another port or place in India , and/or any other vessel having specified period license for coastal trade issued by Director General of Shipping.

In India the Cabotage, which is provisioned in section 406 & 407 part XIV of Merchant Shipping Act,1958, is not absolute . According to this law, only Indian flag vessels can carry cargo from one Indian port to another Indian port , however , permission is granted to foreign flag vessels to ply between Indian ports , incase Indian flag ships are not available.

The Indian National Ship Owners’ Association (INSA) consider the absence of absolute cabotage is the major reason for low investments in coastal shipping and strongly oppose the move of relaxing the cabotage law arguing that this will not give a level playing ground for Indian bottoms.

On checking the past records of coastal trade , it is evident that the present cabotage policy did not boost coastal trade to the desired levels. The % of coastal shipping in India is only 7% against 43% in Europe.

Coastal Shipping- Present Status

Economic reforms in India have triggered a high rate of economic growth in the country and this in turn has led to an increase in transport demand. This demand is being met mainly by the rail and road transport systems. About 50-55% of the freight traffic is carried by road , 30-35% is by rail and only about 7% by coastal shipping .

Though coastal vessel number and tonnage increased from 244 / .60mgt in 2001 to 682/1.0 mgt in 2010, actual number of cargo carrying fleet is very small. The major percentage of fleet is comprises of passenger – cum – cargo vessels, passenger vessels, dredgers etc. And the average age of the coastal fleet is much higher compared to that of overseas fleet with over 60% of its tonnage already overdue for replacement.

According to Alphaliner report given below , the world liner fleet has crossed 15 million TEUs now .

Whereas only 16 Indian container vessels as listed below with about 2200TEUs capacity only available for coastal run at present. (Source :- (Draft )Report of Sub-Group No.VI on Infrastructure to Support Coastal Shipping, Cruise Shipping and Development of Ship Repair, page.11)

Sufficient Ro-Ro or Lo-Lo services , which can carry trucks from one port to another to reduce the cost of double handling, are not available in India at present . Introduction of such high tech vessel will make coastal shipping more attractive. As Indian shipping is not in a position to bring in such new technologies at present due to various reasons, foreign shipping should be permitted to operate.

Coastal Traffic – An overview

The commodities carried by coastal shipping are mainly bulk and break bulk cargo. The passage of cargo to both directions are not equal in coastal shipping and this leads to imbalance. This is because the cargo movement pattern and magnitude is mostly dependent on the production/availability, consumption/demand and the distance separating production centre from points of destination.

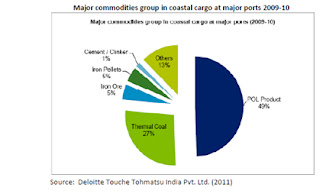

The commodity wise split of costal cargo for 2005-06 and 2009-10 are as under. Though the POL products has the highest share , it is to be noted that the share of liquid /dry bulk cargo has reduced from 94%(2005-06) to 87 % in 2009-10. And there has been an increase of 7% in the share of “Others” (food grains, automotive spares, automobiles, steel, cotton yarn, other containerized cargo etc) due to increase in containerized cargo movement.

Previous studies and surveys reveal that , foreign shipping is more cost effective and technically advanced compared to coastal shipping. This is another reason why foreign ships to be permitted to carry Indian coastal cargo, this policy change can do wonders in reducing logistics costs and enhancing efficiencies. Also would boost multimodal transportation trade , a business of huge potential waiting to be tapped in India.

Containerization – Driving force for coastal shipping.

Containerization density in India is lower (18%), compared to the world average, though rising containerization is one of the key trends expected to drive coastal shipping. Positive upward trend in containerization is evident in the below given chart, an increase of 3.2% from FY04 (14.8%) to FY10(18%).

The commissioning and successful implementation of India’s first International Container Transhipment Terminal at Vallarpadam, Cochin and the proposed Vizhinjam International Transhipment Terminal are expected to catalyze the growth of coastal shipping further as container volumes are projected to flow to/from all the ports more rapidly than before. Presently about 70% of the Indian containerized cargo is getting transshipped at Colombo, Dubai, Singapore and Salalah. The dependents on foreign transshipment ports make the import and export of a country expensive and less competitive in the international market.

The cabotage restriction has an adverse effect on the growth of India’s first and only transhipment terminal, ICTT-Vallarpadam, which is in its infancy. This is a classic example of the necessity of relaxing the existing Cabotage restrictions for the promotion of shipping trade in general and coastal shipping in particular. It is estimated that about 1.2 million Indian cargo, mainly from South Indian ports , is getting transshipped at Colombo and If these containers are transshipped at ICTT there would be substantial savings in the cost as well as transit time . For the success of a hub port, good connectivity ( sea/river, rail ,road )is required to pool cargo from other Indian ports/ overseas and to deliver the cargo to final destinations. From Colombo shipping lines are free to feeder in/out container to any Indian ports without any difficulty and this increases the acceptance of Colombo as a preferred hub port.

The cargo carrying capacity of ships, is several times greater than that of rail wagons or trucks and therefore, coastal shipping offers the benefit of low transport / operating & logistics costs to the trade and industry.

The Department-Related Parliamentary Standing Committee on Transport, Tourism & Culture in their 170th Report on Modernization of Major Ports presented to the Rajya Sabha on 11.8.2011 says this on cabotage: “346. In view of the critical implication of this regulation in the successful implementation of the ICTT project and in the larger interest of economic self-reliance of the Indian EXIM trade, it is imperative that the Cabotage Law is relaxed to enable transshipment of containers through foreign flag vessels from ICTT, Cochin. The Committee, therefore, recommends that the Government should immediately undertake a review of the Cabotage law and take appropriate decision in consultation with all the stakeholders involved”.

Also ,The Director General, Shipping himself recommend in the draft of the Coastal Shipping Policy, “a nuanced approach towards transshipment cargo would require opening it up foreign flag so as to boost containerization and the requisite infrastructure and practices”.

According to INSA this move will adversely affect the growth of Indian coastal shipping. They also argue that the foreign liners have only short term interest and the Indian shipping companies are equipped enough to cater to the expected increase in demand for more feeders . . However , it is difficult to foresee the acquisition of sufficient container ships by Indian companies . Though it is argued that the relaxation would hurt the growth of Indian tonnage, in long run ,by creating demand for the coastal shipping, it would be beneficial.

Key Advantages of coastal shipping.

It is estimated that the nation would save Rs. 15-20 billion through diversion of 5% of cargo from road apart from a reduction in pollutants by 6% and savings in fuel . India’s transportation sector relies heavily on petroleum as its chief energy source, thereby dominating the country’s oil consumption.

Indian marine highways are a vital national resource currently not being used and India should develop a vibrant system of sea highways connecting a network of major/minor ports and the Inland water Transport system which would complement the land bound network .A well developed coastal shipping will substantially help to reduce road accidents, fuel conception and will prove to be an environmental friendly mode of transport.

Also, various studies in India and abroad prove that Coastal shipping can reduce green house gas emission considerably. This makes all the more important that India should look closely at the potential of the coastal shipping transport systems to ease the pressure on surface transport modes and arrest the continuous damage caused to environment.

India should reduce the stress on road and rail and also on environment by diverting a sizable percentage of cargo moved by rail and road to coastal shipping. A relatively modest investment in coastal sea routes with appropriate policy changes, would bring substantial benefits by reducing burden on present transportation system, traffic congestion and pollution