Abstract:

Huge waves of changes have been taking place in the shipping industry, particularly in the container shipping trade, globally and in India too. The container made shipping economical and changed the shape of the world economy. How much the container matters to the world economy and therefore to the Indian economy is impossible to quantify. Containerization, multimodal transport services, advanced marine engineering technology and computerization have made sea transport a prime mode for movement of internationally traded goods.

As container shipping became intermodal, with a seamless shifting of containers among ships, trucks and trains, goods started moving in a stream, from Indian factories directly to the retail stores in the USA and Europe. How much did it cost to send 1,000 men’s shirts from Tirupur to Chicago in 1955 and how did that cost change due to containerization today? The data do not exist. Surely, containerization reduced the cost of moving goods considerably. In the present globalized economy, container is at the centre point of a highly automated system for moving goods from anywhere to anywhere, with minimum cost and complication.

Coastal shipping, which has a vital role to play for the development of Indian economy, has become more than just a fringe issue today. It has become a topic deserving wide attention and action. This paper outlines the current status of coastal shipping in India, provides an overview of coastal traffic, explains how containerization serves as a driving force for coastal shipping and suggests ways and means to enhance coastal shipping in India. This paper throws some light on the huge potential of containerization in India and offers a turning point in the coastal shipping debate.

A Snap Shot of Indian Coastal Shipping

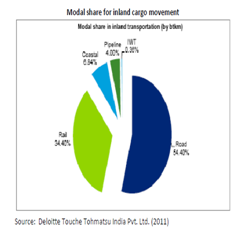

Economic reforms in India have triggered a high rate of economic growth in the country and this in turn has led to an increase in transport demand. At present this demand is being mainly met by the rail and road transport systems. About 50-55% of the freight traffic is carried by road , 30-35% is by rail and only about 7% by coastal shipping.

Indian seaborne trade has been growing at a rate of over 11% in the last 10 years. However, the Indian tonnage is not growing in pace with the fast growing maritime trade. As on 31st March 2011, India had 708 vessels under coastal trade and 347 vessels under overseas trade totaling to a fleet size of 1055 ships (source INSA report) with a 10.36 million gross tonnage. In terms of fleet size, the Indian shipping industry makes only a marginal share of just about 1% of the global fleet.

Though coastal vessel number increased from 244 in 2001 to 708 in 2011(as on 01.03.2011, source INSA report), actual number of cargo carrying fleet is very small. The major percentage of fleet comprises of passenger – cum – cargo vessels, passenger vessels, dredgers etc. As per INSA report, around 52%of the Indian shipping fleet are over 20 years of age and overdue for replacement.

Government of India has envisaged an ambitious plan to grow the Indian shipping fleet from 10 million GT to 40 million GT by the year 2020. Despite the global downturn, Indian domestic trade is expected to remain strong and coastal shipping would retain its strong potential.

Cargo Traffic – An Overview

Four traffic segments viz; containers, coal, iron ore and petroleum, make up 80% of India’s port traffic.Though the POL product has the highest share in coastal traffic , it is to be noted that the share of liquid and dry bulk cargo has reduced from 94% in 2005-06 to 87 % in 2009-10. There has been an increase of 7% in the share of “Others” (food grains, automotive spares, automobiles, steel, cotton yarn, other containerized cargo ) due to increase in containerized cargo movement. This proportion is likely to increase as container traffic grows with increasing diversification of India’s trade basket.

Presently, the containerization level of general cargo that can be containerised is only 68% in India against the international levels of around 80%. Further increase in containerisation of bulk cargo is expected over the next few years. Impressive growth rate of about 22% (excluding 2008-09) in container traffic is evident from the following table. This increased penetration of containerization is expected to push domestic traffic volumes to higher levels.

Source : Maritime Agenda 2010-2020

As per the below container traffic analysis chart , container demand in India is forecast to grow about 21 million TEUs by 2020.

Containerization has been growing steadily in coastal shipping , an increase of 3.2% from FY04 (14.8%) to FY10(18%), and is one of the key trends expected to drive Indian coastal shipping to higher levels.

Containerization – Emerging opportunities.

Globalization and trade liberalization coupled with developments in transport, logistics and communication technologies have stimulated a noticeable shift in manufacturing activities towards countries like India. Booming automobile industry, increasing industrialization, growing project cargo moves for power and construction sector , port development and retail trade reforms are expected to give a thrust to the fast growing container traffic in India.

1. Automobile Industry

Trade liberalization attracted foreign auto giants like Hyundai, Nissan, Scoda, BMW etc to set up their production facilities in India. Containerisation of goods ( spares, semi-finished and finished products) is the key technology in making multimode transport in supply chain more effective and efficient. As the Indian automotive sector is booming like never before, the relevance of logistics and the supply chain have become all the more important.

Source – ACMA

The just-in-time manufacturing strategy (supplier makes the goods only when the customer needs them and then ships it in containers, to arrive at a specified time) adopted by the automakers stimulate containerization in the auto industry. Also the increasing usage of containers for the movement of automobiles to dealers across the country is another potential area for coastal traffic.

2. Retail Trade reforms

India’s growing domestic market is one of the major strengths for containerisation. The India Retail Industry is gradually inching its way towards becoming the next boom industry and there is great potential for the organized retail industry to prosper in India. In November 2011, Government of India announced retail reforms for both multi-brand stores and single-brand stores and these market reforms expect to pave the way for retail innovation and increased domestic container traffic.

3.Increasing Industrialization

India is becoming the most preferred destination for manufacturing outsourcing in the world, offering greater potential for containerisation. The growing industrialisation in India will boost containerisation in the country. Original equipment manufacturers (OEM) such as Samsung and LG Electronics and electronics manufacturing services (EMS)providers such as Solectron, Flextronics and Jabil already have well-established facilities in India.

For modern production processes, components of goods are often produced as semi-manufactured goods, re-exported in containers and assembled into final products. These final products may also be exported in a container. The growth in semi-manufactured goods and the use of transhipment has thus helped container throughput to thrive in recent decades.

4. Increase in project cargo movement

The sunrise industry within the logistics sector is the movement of Over Dimensional Cargo (ODC) commonly termed as project cargo. It involves movement of uneven-sized machinery and material in special equipments like open top and flat rack containers.

Project cargo movement is rising in industries like power, oil and gas, mining etc. Government’s decision to attain self-sufficiency in power generation has resulted in the sanction of power plants to be set up across the country. For instance, 34 hydro-electric power plants are being set up in the state of Arunachal Pradesh and it presents huge potential for movement of project cargo on the National Waterway 2 (NW-2) from Kolkata to the hinterland of Arunachal Pradesh. In addition to this, organisations across the country are expanding their capacity and building new plants, thereby giving thrust to the domestic ODC movement.

5. Development of Transhipment terminals

The commissioning and successful implementation of India’s first International Container Transshipment Terminal at Vallarpadam and the proposed Vizhinjam International Transshipment Terminal are expected to catalyze the growth of coastal shipping further as container volumes are projected to grow much higher from all Indian ports. Presently about 70% of the Indian containerized cargo is getting transshipped at Colombo, Dubai, Singapore and Salalah. The strategic location of transshipment terminals makes them ideal for the inter-coastal movement of domestic Indian containers through coastal shipping.

The Growth Drivers

While the challenges facing the container industry may be significant, a number of opportunities are also emerging. New arteries of growth are opening up and more value added services are being packed into containers. The potential is big and many industry players are aware of it.

1. Indian container vessels for coastal traffic.

The level of world fleet had gone up in 2009 with the world merchant fleet exceeding 1 billion dwt . The fleet of container ships increased by 11.9%, reflecting the growing share of traded goods being containerized. According to “Containerisation International” April 2012, the world fleet of container ships as of now stands at 5,036 ships for 15.6 TEUs.

Source – Alphaliner Report

Whereas only 16 Indian container vessels as listed below with about 22,000TEUs capacity are available for coastal run at present. (Source :- (Draft )Report of Sub-Group No.VI on Infrastructure to Support Coastal Shipping, Cruise Shipping and Development of Ship Repair, page.11) which is not sufficient to cater to the projected container traffic, domestic as well as transshipment .

Sufficient Ro-Ro or Lo-Lo services , which can carry trucks from one port to another to reduce the cost of double handling, are also not available along the Indian coast at present . Introduction of such efficient multimodal transport system will make coastal shipping more attractive.

2. Cabotage policy relaxation

The cabotage restriction has an adverse effect on the growth of India’s first and only transhipment terminal, ICTT-Vallarpadam, which is in its infancy. This is a classic example of the necessity of relaxing the existing Cabotage restrictions for the promotion of shipping trade in general and coastal shipping in particular.

When the coastal container trade is open to international competition , it would create an enabling environment for faster growth of transshipment traffic. The volume of container traffic handled at Colombo for the calendar year 2011 is 4.2 million TEUs of which about 72% represent transshipment cargo. Of this, about 70% (1.99 million TEUs) per annum is transshipment from Indian Ports, and out of which, 60 % (1.19 million TEUs) is to and from South Indian Ports; which could be the potential business for ICTT Vallarpadam. ( Source – Report of Parliamentary standing committee on transport , tourism & culture ,107th report on modernization of Major ports PRESENTED TO THE RAJYA SABHA ON 11.08.2011).

With the relaxation of cabotage law, more number of feeder vessels would be calling at Indian ports with greater frequency and efficiency which in turn will be beneficial to Indian shippers and consignees. In a market environment with enhanced shipping services, reduced cost and frequent sailing opportunities there will be greater chance for transport mode change of containers from road and railways to coastal shipping.

3. Minimize equipment imbalances and repositioning cost

Similar to the international container shipping industry, Indian industry too face serious trade imbalances and equipment storage, repositioning issues. To minimize the port / depot congestion and the equipment dwell time, carriers are forced to make logistic vessel calls to evacuate the excess equipment. Due to insufficient port / depot infrastructure and poor logistics management strategies , the whole process of evacuation used to be cumbersome , time consuming and expensive. This situation demands for an empty container management strategy which rationalizes the repositioning, storage and maintenance of empty containers. The problem of trade imbalances and repositioning of empty container will continue to be a serious transportation logistics issue.

As per the existing regulations, foreign marine containers are not permitted to use for coastal traffic. Relaxation of this rule would result in greater use of idling international containers in domestic service and this could considerably reduce the logistics cost of both overseas and domestic carriers. Availability of sufficient equipment at the right place at right time surely will boost containerization in domestic traffic.

4. Creation of adequate Container Freight Stations and warehousing facilities

CFS is an off dock facility located near the servicing ports which helps in decongesting the port by shifting cargo and Customs related activities outside the port area. Modern and technologically advanced CFSs play a significant role in effective custom clearance activities in the port, and thereby shorten the turnaround time of ships. More CFSs need to be developed in the vicinity of export clusters across the country to promote containerization.

Warehousing and storage is also an integral part of the logistics industry and plays a very important role in the shipping industry. With an increasing number of ships calling at Indian ports, storage and warehousing facilities need to be upgraded manifold. Domestic ports suffer from inadequate storage facilities, which result in delay in consignment delivery.

5. Promotion of Multimodal Transport System

Multimodal transport, which is an integral part of supply chain management, refers to the transportation of goods using more than one mode of transport in an integrated and seamless manner from the origin to the destination. Containerization of goods is a key technology in making multimode transport in supply chain more effective and efficient. Also, the Indian shipping companies now offers an end- to- end logistics solutions and a well developed intermodal transport system is an absolute necessity for the seamless movement of containers.

6. Creation of Multimodal Logistics Parks

Another trend has been the establishment of multi-modal logistics parks. These multi-modal logistics hubs have been planned to provide total transport solution and other value-added services to industry in and around the dedicated freight corridors.

Each logistics park will have a container terminal for both domestic and international operations, specific commodity handling terminals, storage and distribution as well as transhipment facilities, cold storage and product-specific warehouses as well as hotels, banks, food parks and entertainment centres. Such trend would open up new avenues and opportunities for manufacturers, retailers, suppliers, and logistic players to improve their supply chain. It may be mentioned that Indian railways have identified 11 sites in the Delhi-Mumbai corridor for developing multi-modal logistics parks.

End Notes – Coastal Shipping nourishes a new nation.

Despite having a rich and proud Maritime tradition and a long coastline of about 7517km studded with 13 major and 185 Non-Major (Minor / Intermediate) ports , the potential of coastal shipping has not yet been fully exploited in India. Though coastal shipping has evident advantages over the land based modes of transportation, it has not yet become an integral part of the country’s transport infrastructure. The cargo carrying capacity of ships, is several times greater than that of rail wagons or trucks and therefore, coastal shipping offers the benefit of low transport and operating & logistics costs to the trade and industry.

The importance of maritime transportation in the economic development of the country can be seen from the fact that 95% of India’s EXIM trade by volume and 77% by value, moves by sea. At present Indian seaborne trade constitutes only 3.66% of the global seaborne trade and with the kind of projections mentioned, it can reach a significant 9.3% by the year 2020. Coastal shipping has a significant role to play in supporting Indian economy to achieve this ambitious target.

As observed, the future of maritime trade is expected to be containerized cargo and there will be intense competition for a share of this market between the East and West Coast ports and the regional ports themselves, which would be advantageous for coastal shipping. The coastal trade, especially the container shipping sector, should be thrown open to international companies for the benefit of the EXIM trade as competition is expected to bring in service reliability , quality, speed of delivery and cost reduction.

Shipping connectivity is an important determinant of trade competence. The time has now come for policy makers to rethink their development philosophy to focus on non-major ports, transhipment hubs, inland ports, transport corridors, IWT as well as coastal shipping. A net working of Sea ports, inland ports and CFSs are vital for the development of container trade.

The economic progress of India depends on the value addition of its trade, commerce and industry. A comprehensive and strategic transportation plan, national and international in its scope, is the need of the hour.

Coastal shipping has an important role to play in making our nation more economically competitive, our transportation networks more environmentally clean, and our nation’s infrastructure safe, secure and globally integrated.

Hi Asha

ReplyDeleteI feel before we give access to foreign flag vessels to ply on our domestic sea lanes, we should provide all the benefits to Indian ship owners to own and run their ships on the coast. The govt. needs to seriously look at the issues with tax regime, ship financing options, Insurance , manning regulations and customs rules and regs. In addition, building quality port infrastructure is just one part of the equation, having seamless transfer/offtake to the hinterland through quality, efficient and cost efficient logistics solutions is equally important.